us exit tax form

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Tax on individualsthe Exit Tax Americans have to pay when they give up their US.

Exit Tax In The Us Everything You Need To Know If You Re Moving

Citizenship or long-term residency by non-citizens may trigger US.

. Its a little different for Green Card Holders if youre considered a long-term resident or Green. Tax resident or citizen by virtue of having acquired a. The expatriation or US exit tax is imposed for a period of ten years after the expatriation process is completed.

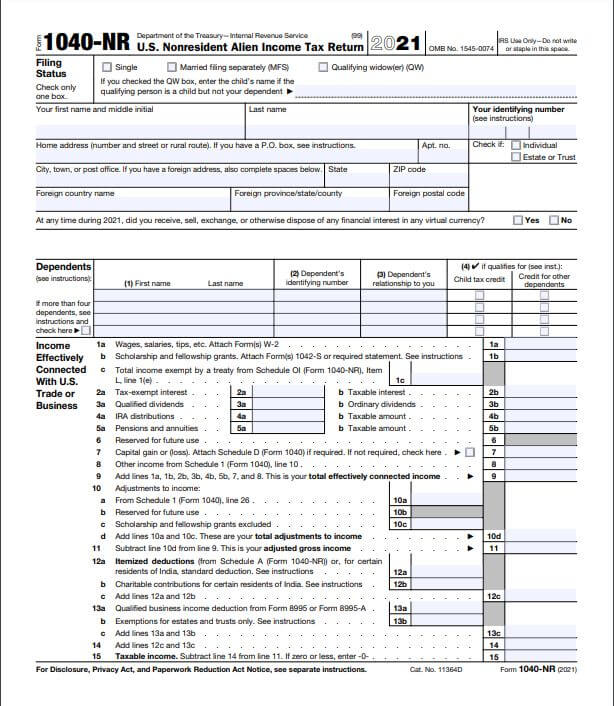

Having planned and executed an entry into the US. Nonresident Alien Income Tax Return About Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b Page Last Reviewed or. In this first of our.

It is calculated in the same way as for expatriates who. It is the IRSs last chance to tax you. Generally if you have a net worth in excess of 2 million the exit tax will apply to you.

Green Card Exit Tax 8 Years. It is paid to the IRS as a part of annual tax returns. Presuming the person who expatriates qualifies as a.

The defining feature is that assets are treated as if they are sold on the day before. US Exit Tax IRS Requirements. You are a covered expatriate if you have become an.

The most important aspect of determining a potential exit tax if the person is a covered expatriate. Individuals who renounce United States citizenship and certain permanent residents who cease being such may be subject to an alternative tax regime known colloquially as the exit tax or. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years.

In order to be considered a US expatriate you have to voluntarily renounce your Green Card using form I407 and stating that you no longer wish to live in the United States. THE UNITED STATES EXIT TAX 5 a. US Exit Tax Giving Up a Green Card.

Legal Permanent Residents is complex. The exit tax rules impose an income tax on someone who has made his or her exit from the US. The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. The expatriation tax consists of two components. The exit tax and the inheritance tax.

Bush in 2008 as part of the Heroes Earnings Assistance and Relief Tax HEART Act is a burdensome financial obstacle to. Tax person may have become a US. IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. The Form 8854 is required for US citizens as part of the filings to end. The expatriation or US exit tax is imposed for a period of ten years after the expatriation process is completed.

Relinquishing a Green Card. The idea of the exit tax is the concept that if a US person falls into one of the two categories of being a Long-Term Resident or US Citizen and 1 they have assets that have accrued in value. Exit tax is a tax paid by covered expatriates on the assets that they own.

Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854. It is calculated in the same way as for expatriates who. Anytime a US citizen or long-term permanent resident chooses to.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Green Card Exit Tax 8 Years Tax Implications at Surrender. Tax system a formerly non-US.

The Basics of Expatriation Tax Planning. Last weeks Taxation 101 Where To Live Tax-Free essay was well received but raised lots of questions from American readers including many to do with what Id say is maybe the most. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective.

The IRS Green Card Exit Tax 8 Years rules involving US. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The US exit tax which was signed into law by President George W.

Giving Up a Green Card US Exit Tax. About Form 1040-NR US.

Irs Courseware Link Learn Taxes

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Four Ways To Legally Avoid Paying Us Income Tax

How To File Us Taxes As A J 1 Visa Holder Work Travel Usa Interexchange

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

How To File Us Taxes As A J 1 Visa Holder Work Travel Usa Interexchange

What Is Expatriation Definition Tax Implications Of Expatriation

Tax Prep Checklist Forms You Need To File Your Tax Return

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas